property tax liens nj

Property taxes are due in four installments during the year. The lien attaches to real property for example a home or land and personal property for example a piece of jewelry you may own at the time the lien is filed.

Bid4assets Com Online Real Estate Auctions County Tax Sale Auctions Government Auctions Online Taxes Dream Big Real Estate

5519-56 Sale of tax lien on abandoned property.

. Ad Find Jersey County Online Property Liens Info From 2022. 1 If the municipality or the authority or its subsidiaries acquires the tax sale certificate for a property on the. Find the best deals on the market in Linden NJ and buy a property up to 50 percent below market value.

Linden NJ tax liens available in NJ. Unsure Of The Value Of Your Property. The Tax Court of New Jersey provides this information as a public.

Search Atlantic County inmate records through Vinelink by offender id or name. February 1 May 1 August 1 and November 1. Atlantic County Sheriff and Jail.

Register for Instant Access to Our Database of Nationwide Foreclosed Homes For Sale. Ad HUD Homes USA Can Help You Find the Right Home. Public Property Records provide information on land homes and commercial properties.

The codicil specificallyy stated who owned what property. A New Jersey Property Records Search locates real estate documents related to property in NJ. By Mail - Check or money.

Up to 25 cash back In New Jersey the length of the redemption period depends on whether a third party bought the lien at the sale and whether the home is vacant. A property lien in New Jersey is the legal right that a creditor has to obtain assets owned by a debtor if outstanding debts are not paid. A lien is a claim legally placed on a piece of property splitting the ownership of the property between a debtor the lienee and their creditor the lienor or lienholder.

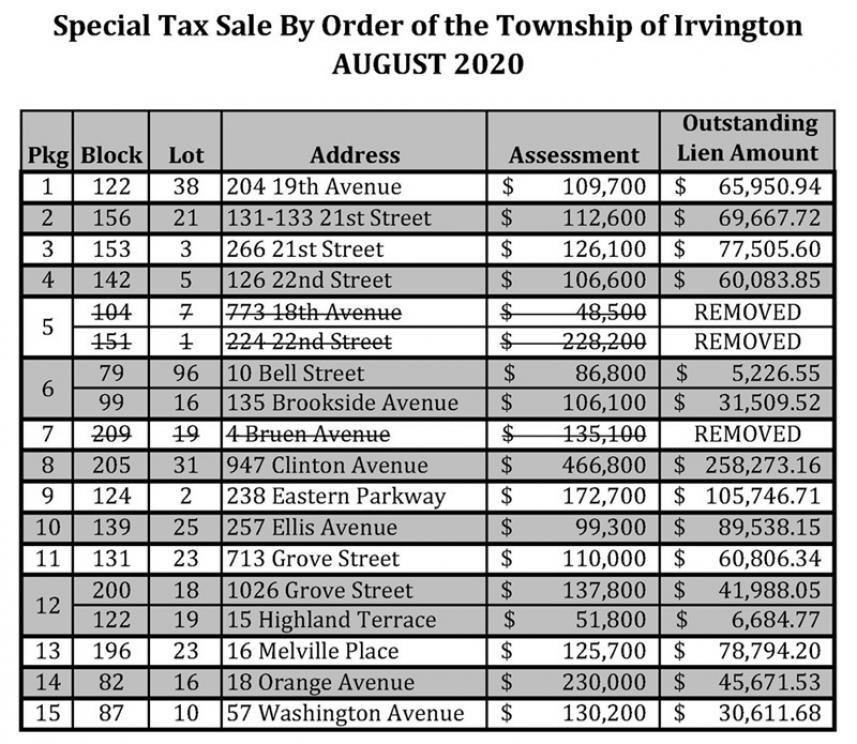

There are currently 142799 tax lien-related investment opportunities in New Jersey including tax lien foreclosure properties that are either available for sale or worth pursuing. Title File Date Block Lot Unit Asmt Yr. Sheriff Jail and Sheriff Sales.

The tax applies to all decedents who died. According to New Jersey Law on tax lien certificate greater than 200 a penalty of 2 is added to the tax lien certificate tax lien certificates greater than 5000 bring a 4 penalty and tax. If you need a Release or Subordination of Tax Lien for refinance or foreclosure of real estate.

The Plaintiff in a tax sale foreclosure. LOCAL PROPERTY TAX CASES from 01012022 to 08122022 Docket No. Find All The Assessment Information You Need Here.

In fact the rate of return on property tax liens. In Person - The Tax Collectors office is open 830 am. Now heirs own those homes separately codicil states they must pay their taxes and upkeep their own properties.

Up to 25 cash back A lien effectively makes the property act as collateral for the debt. All states have laws that allow the local government to sell a home through a tax sale process to. This post discusses only those tax sale foreclosures completed by individual non-municipal TSC holders.

The up to 35000 payment would come in the form of a three-year forgivable loan which would be listed as a lien on the property with no interest or payments due. This post discusses the creation and priority of federal tax liens recorded against real estate in New Jersey that has been sold to a good faith purchaser disclaiming any. Tax lien certificates in New Jersey are issued in accordance with the following rateBidders will be taking part in an auction because it is a down bidding processWe bid down.

In New Jersey property taxes are a continuous lien on the real estate. HOW TO PAY PROPERTY TAXES.

What Are The Different Types Of Property Liens

The Essential List Of Tax Lien Certificate States

Tax Sales Secrets How To Buy Tax Liens And Tax Deeds

Federal Tax Lien Irs Lien Call The Best Tax Lawyer

Tax Lien The Complete Guide To Investing In New Jersey Tax Liens By Michael Pellegrino

New Jersey Tax Sales Explained Tax Liens Tax Deeds A Goldmine For Real Estate Investors Youtube

New Jersey Tax Liens Explained Florida Tax Lien Tax Deed Research Youtube

Franklin New Jersey Tax Lien Online Auction Tax Sale Review Youtube

What Is A Federal Tax Lien Tomes Law Firm Pc

Property Tax Lien Nft Buy Tax Liens Online Property Tax Liens On Unique Exchange

How To Remove A Lien On Your Home New Home Buyer Us Real Estate Lets Do It

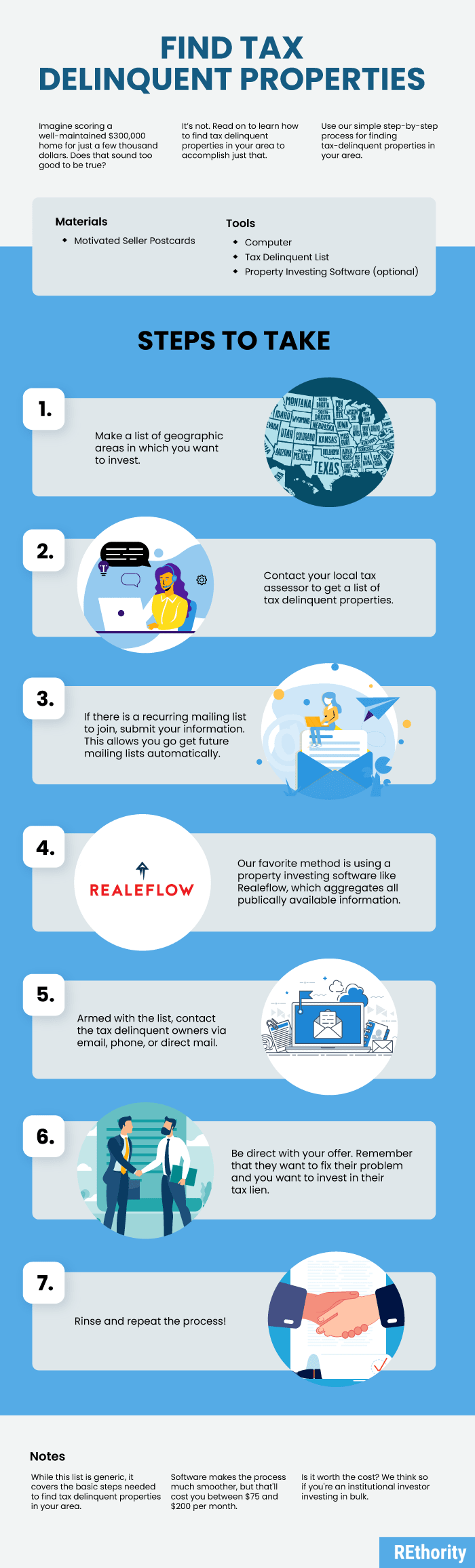

How To Find Tax Delinquent Properties In Your Area Rethority

How To Buy Real Estate Tax Liens And Earn Up To 36

If You Wish To Invest In Tax Lien Properties The State Of New Jersey Conduct Online Tax Sales Online Taxes Bid Tax

How To Find Tax Delinquent Properties In Your Area Rethority

Tax Lien The Complete Guide To Investing In New Jersey Tax Liens By Michael Pellegrino